[ CICT = CMT + CCT ]

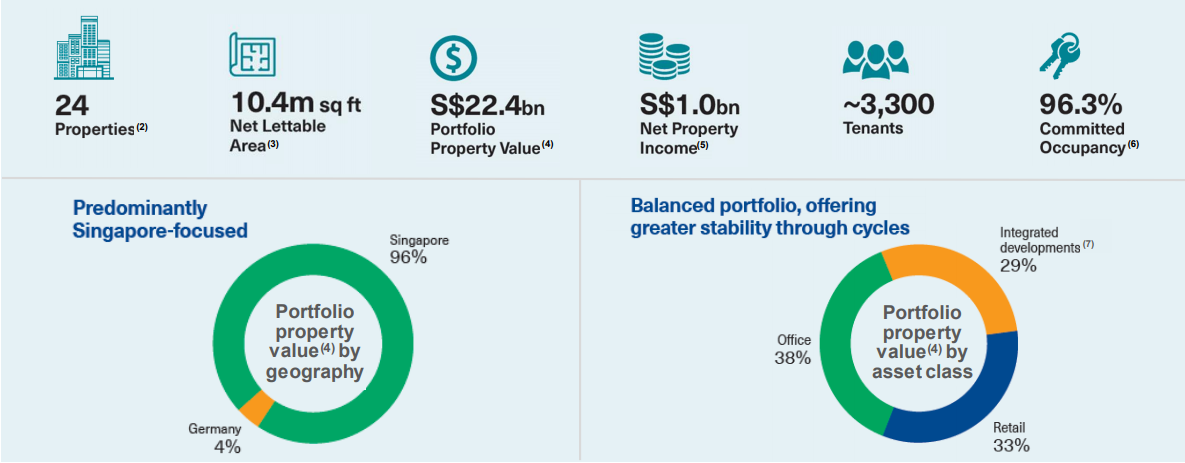

Merged entity (CICT) will be the largest S-REIT and one of the largest REITs in Asia Pacific with an asset base of S$22.4 billion

Singapore, 29 September 2020 – Unitholders of CapitaLand Mall Trust (CMT) and CapitaLand Commercial Trust (CCT) have voted resoundingly in favour of the proposed Merger of CMT and CCT to create a diversified commercial real estate investment trust (REIT), to be named “CapitaLand Integrated Commercial Trust” (CICT) following completion of the transaction. More than 3,000 unitholders voted by proxy at CMT’s Extraordinary General Meeting (EGM) and CCT’s EGM and Trust Scheme Meeting held via electronic means today.

All five resolutions at the three meetings were duly passed and well supported. At CMT’s EGM, approximately 98.89% of the total number of votes were in favour of the proposed Merger by way of the Trust Scheme; while approximately 98.88% of the total number of votes were in favour of the issuance of new CMT units as part of the Scheme Consideration for the Merger. Pyramex Investments Pte Ltd, Albert Complex Pte Ltd, Premier Healthcare Services International Pte Ltd, CapitaLand Mall Trust Management Limited and their associates abstained from voting on these resolutions. For purposes of good corporate governance, Mr Jason Leow, who is concurrently the President, CapitaLand Singapore & International of CapitaLand Group, and Mr Jonathan Yap, who is concurrently the President, CapitaLand Financial of CapitaLand Group and a director of CapitaLand Commercial Trust Management Limited, also abstained from voting on these resolutions.

At CCT’s Trust Scheme Meeting, the resolution on the Merger by way of the Trust Scheme received approximately 90.31% approval by headcount representing approximately 98.23% in value of the total number of CCT Units held by CCT Unitholders who voted. The CCT Manager, the CMT Manager’s concert parties, as well as the common substantial unitholders of CMT and CCT, abstained from voting on the Trust Scheme Resolution at CCT’s Trust Scheme Meeting.

The resolution on the CMT Trust Deed Amendments at CMT’s EGM and the resolution on the CCT Trust Deed Amendments at CCT’s EGM were approved with approximately 99.75% and approximately 96.04% of the total number of votes respectively.

Mr Tony Tan, CEO of CMT Manager, said: “We are heartened and humbled by the resounding support given by CMT Unitholders for the Merger. To receive a strong mandate amidst the uncertainties of COVID-19 to deliver the transformative merger is an honour and a responsibility we do not take lightly. Underpinned by leadership and resilience, the Merged Entity will be in a stronger position to seize the opportunities across retail, office and integrated developments in our focus market of Singapore. We remain firmly committed to delivering sustainable distributions and long-term returns for our unitholders, something we have been doing in CMT and will continue to do in CICT. We thank CMT Unitholders for your trust and support as we embark on this new journey as CICT.”

Mr Kevin Chee, CEO of CCT Manager, said: “We are encouraged by the decisive vote that CCT Unitholders have given for the Merger. The unwavering confidence and trust that CCT Unitholders have placed with us over the years and for this Merger is received with humility and gravity, and we are truly grateful. The Merger is an important milestone in our journey through evolving market trends and a changing real estate landscape to deliver sustainable returns to CCT Unitholders. The Merger with CapitaLand Mall Trust to form CapitaLand Integrated Commercial Trust will put us at the forefront to seize opportunities, create value and weather uncertainties and challenges. We remain resolute in our commitment to CCT Unitholders to deliver long-term sustainable returns through the new Merged Entity.”

CICT is expected to be one of the largest REITs in Asia Pacific and the largest REIT in Singapore by market capitalisation (S$12.7 billion) and total portfolio property value

(S$22.4 billion). It is also expected to be the largest proxy for Singapore commercial real estate with a diversified portfolio of 24 strategically-located and high-quality retail, office and integrated developments in Singapore and overseas.

Under the Trust Scheme, CMT will be acquiring all the units in CCT held by CCT Unitholders in exchange for a combination of new units in CMT and cash. The consideration for each CCT Unit under the Trust Scheme (Scheme Consideration) comprises 0.720 new CMT Units (Consideration Units) and S$0.2590 in cash (Cash Consideration).

Subject to obtaining the necessary approvals, the Merger is expected to become effective on Wednesday, 21 October 2020. CCT’s last day of trading is expected to be Friday, 16 October 2020.

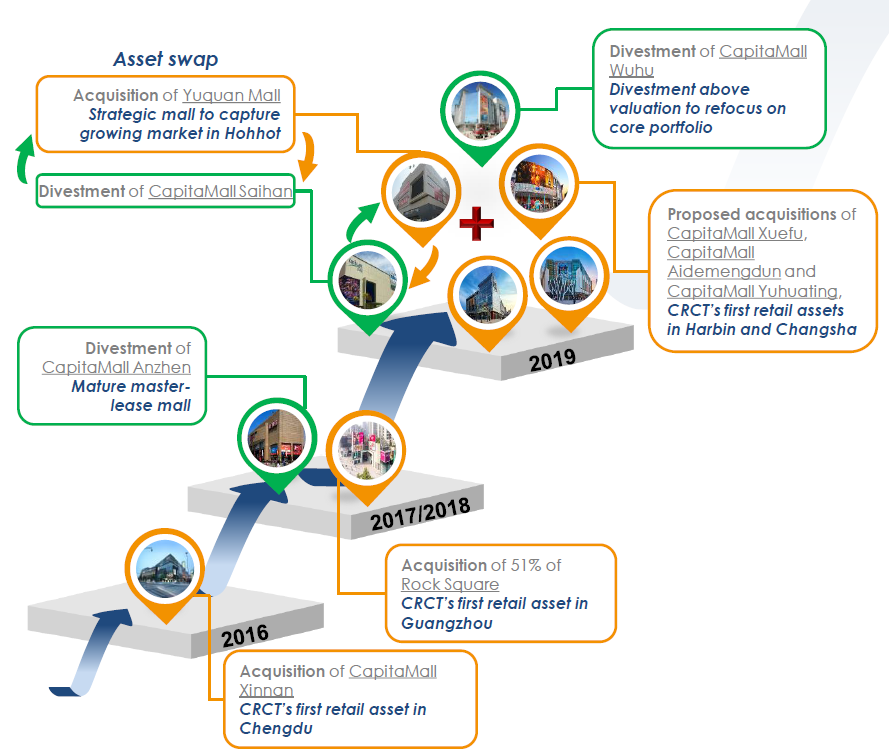

CapitaLand Retail China Trust Management Limited (CRCTML), the manager of CapitaLand Retail China Trust (CRCT), today announced that CRCT has entered into an agreement with a subsidiary and associated companies of CapitaLand Limited to acquire 100% interests in three companies that hold three malls in China –CapitaMall Xuefu and CapitaMall Aidemengdun in Harbin and CapitaMall Yuhuating in Changsha. The accretive acquisition will diversify CRCT’s footprint in China from eight cities to 10 and enable it to gain exposure to two rising provincial capital cities with strong economic fundamentals and long-term growth potential, namely Harbin in Heilongjiang Province, north China and Changsha in Hunan Province, central China.

CapitaLand Retail China Trust Management Limited (CRCTML), the manager of CapitaLand Retail China Trust (CRCT), today announced that CRCT has entered into an agreement with a subsidiary and associated companies of CapitaLand Limited to acquire 100% interests in three companies that hold three malls in China –CapitaMall Xuefu and CapitaMall Aidemengdun in Harbin and CapitaMall Yuhuating in Changsha. The accretive acquisition will diversify CRCT’s footprint in China from eight cities to 10 and enable it to gain exposure to two rising provincial capital cities with strong economic fundamentals and long-term growth potential, namely Harbin in Heilongjiang Province, north China and Changsha in Hunan Province, central China.